Introduction

The global pulse market is undergoing a significant transformation, driven by a confluence of factors that are shaping consumer preferences, agricultural practices, trade dynamics and climate change.

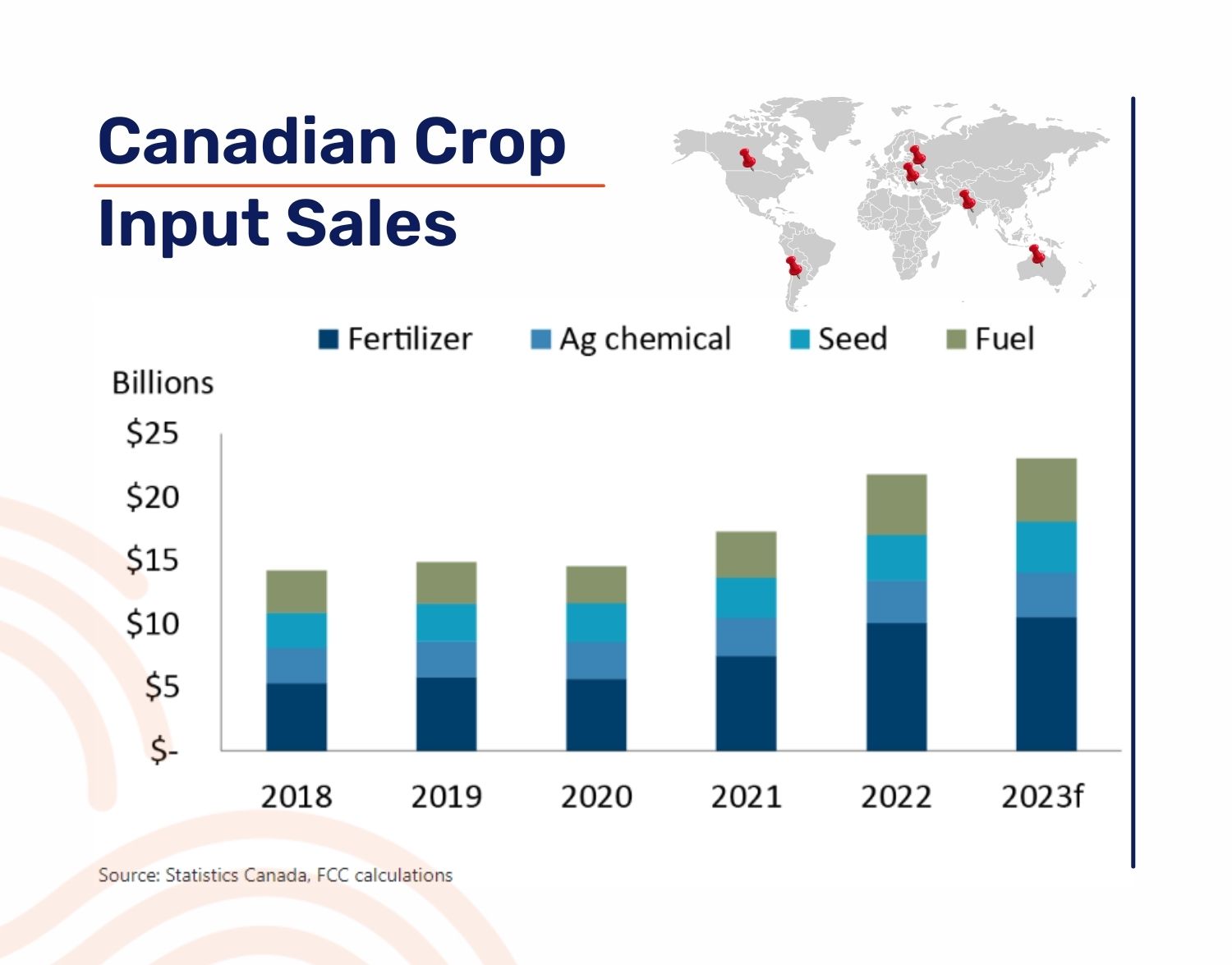

Rising Agricultural Costs: The global agricultural landscape is grappling with escalating costs. Key farm inputs, including feed, fuel, and fertilizer, have witnessed a sharp uptick in prices over the past few years. While some factors have seen a decline in 2023, they have not reverted to their previous low levels, indicating a sustained pressure on the cost front.

Climate Impact: The strong El Niño events of 2023/2024 have disrupted weather patterns, causing reduced rainfall in key regions like India, Southeast Asia, and Australia, negatively impacting crop yields. Conversely, areas like the US have seen increased rainfall, leading to over-saturation and harvest issues. Specifically, India’s erratic weather has pushed food prices up by over 11%, with pulses experiencing a 20% hike since the year’s start.

Demand for Pulses: With a rising global focus on health, consumers are increasingly opting for fibre-rich and low-fat diets. This trend has amplified the demand for pulses, leading to their integration into diverse food products like pasta, bakery items, dry snacks, and meat alternatives.

Given these dynamics, the pulse market is set for significant shifts, presenting both challenges and opportunities for industry participants.

Growing Areas

Pulses, with their adaptability to diverse climatic conditions, are cultivated extensively worldwide. In India, a major pulse-producing nation, the primary crops include Lentils and Field peas. The country’s vast agricultural landscape allows for the cultivation of a variety of pulses, making it a significant player in the global pulse market.

North America, particularly Canada, stands out as a dominant force in the pulse industry as well. Canada is not only one of the largest dry pea producers but also a major exporter, catering to global demand. The expansive farmlands of Canada and parts of the U.S.A. provide an ideal environment for pulse cultivation, reinforcing North America’s position as a key pulse-producing region. The graph shows how Canadian crop input sales has increased, driving up production costs.

Chickpeas

India remains a powerhouse in the chickpea market, holding a commanding 74.96% share. However, the country grappled with reduced yields due to a severe hot and dry spell in December. This weather anomaly has led to a notable global supply gap of approximately 100,000 metric tonnes.

In 2023, Canada reported a chickpea production of 132,575 metric tonnes. The market dynamics are currently influenced by limited supply offers, especially from major producers like Canada and Argentina, resulting in steady and potentially firmer prices.

While Australia’s chickpea exports dipped in April, there’s an anticipated 15% increase in cultivation area for the 2023/24 season. This expansion, however, is expected to yield a production similar to the previous year, around 544,000 tonnes.

Projections from Turkey and Mexico estimate chickpea productions of 580,000 tonnes and 118,000 tonnes for 2023, respectively. The global chickpea market is rife with uncertainties, especially emanating from North American producers.

With challenges in production across various regions and a tight global supply anticipated for the next 12 months, prices are expected to remain robust.

Black Beans

There’s a heightened demand for black beans from Brazil and Mexico, making the markets cautious as they await harvest results on yields and quality. Currently, there are limited offers available from all origins. On the domestic front, bean yields have been consistent year on year. However, late harvesting and unpredictable weather patterns have played a role. The UK harvest is approximately 90% complete, with yields at 2.9t/ha. The quality this season is subpar compared to previous years, with a notable decline in human consumption quality due to high insect damage levels.

White Cannellini Beans

The current outlook for white cannellini beans, particularly from Argentina, is not promising. Factors such as late sowing, decreased moisture, and reduced planted area have contributed to a challenging season. Among the bean crops in Argentina, Alubias were hit the hardest, with an estimated production drop of 30% compared to the previous year. As the harvest nears completion, the market has observed a significant number of small-sized beans. Given the current scenario, it’s advisable to secure coverage for the season.

Red Kidney Beans

The red kidney beans market is currently experiencing some challenges. Rain during the harvest period has temporarily halted selling activities, leading to a firmer market sentiment. In Argentina, the availability of beans with good quality is diminishing, and current offerings are priced higher than the previous month. After two rounds of Algerian tendering, Argentina is either mostly sold out or hesitant to sell, resulting in a sharp price increase and reduced availability. North America, too, is reacting to the global situation and their own suboptimal harvest conditions. All indicators suggest a consistently strong market for the upcoming period.

Butter Beans

Butter beans have thrived in the long hot summer and well-drained soil, with Peru being a primary producer. The US has already sold about 70% of its 2023 harvest, indicating a strong demand. The market is anticipated to remain firm, with a potential sell-out scenario. Fortunately, Peru is currently offering reasonable prices and substantial volume. Additionally, new crop offers from Europe are now available, and the recent harvest appears to be bountiful, leading to a significant drop in prices. It’s recommended to secure coverage given the market trends

Lentils

Harvest delays in North America, particularly due to rain, have caused a surge in prices. This is compounded by a lack of selling from growers. The Canadian lentil crop is projected to be the smallest in five years, totalling 1.536 million tonnes, primarily due to drought conditions and subpar yields.

India’s demand for lentils, as a substitute for pigeon pea, is notable. With the pigeon pea harvest starting in October, there’s potential for price reductions by year-end. However, Indian red lentil prices have surged due to a suboptimal domestic crop and robust demand.

Argentina’s market is tight, with higher prices than the previous month. The country has been cautious in selling after Algerian tendering, leading to a sharp price increase. Australia anticipates a lentil production of 1.3 million tonnes for 2023-24, a slight increase from the previous year. However, dry conditions in key regions might affect yields. Despite this, Australia’s lentil exports have been robust, with India being a significant importer. Russian red lentil prices have seen a significant rise, following trends in Canada and Australia. While the quality of Russian lentils is perceived as lower, India has allowed unrestricted imports of Russian lentils until June 2024, addressing the surge in demand. Turkey harvested 450,000 tonnes of lentils in 2023, with domestic prices rising sharply due to increased demand and concerns about the Canadian crop. The country has re-entered the import market, purchasing Canadian lentils at premium prices.

The global lentil market is poised to remain tight, primarily due to Canada’s smaller crop and India’s strong demand. This scenario suggests that lentil prices will likely stay elevated in the foreseeable future, benefiting producers but potentially leading to higher consumer prices.