-

-

25 March 2024Market Update: Sweetcorn March 2024Compiling comprehensive data on the sweetcorn market has historically presented challenges due...

25 March 2024Market Update: Sweetcorn March 2024Compiling comprehensive data on the sweetcorn market has historically presented challenges due... -

22 March 2024Market Report: Tomatoes March 2024The global tomato market has witnessed unprecedented volatility and price levels over...

22 March 2024Market Report: Tomatoes March 2024The global tomato market has witnessed unprecedented volatility and price levels over...

Market Update: Energy July 2022

21 July 2022

OVERVIEW

It is important to reiterate and emphasise the realities of Energy challenges in food production, and how this is a key driver of the price increases we’re currently observing.

The rationing of Gas during the winter in the EU remains a key concern, as this will make production during the post-harvest period extremely expensive. Also, the harsh reality is that this impacts (directly or indirectly) everything that we consume/buy/produce globally.

We can expect this to get worse before it gets better. As such, this will have a significant impact on commodities, below a few examples:

- Expected that commodities will all be impacted in upward trend.

- All commodities impacted due to transport, production, running factories etc.

- Expected to exacerbate the inflation that we are seeing.

- Costs in greenhouses/modified environments will be hit hard.

- Options are to absorb or produce less – this will have huge impact on availability.

- Processed products in general will be hardest hit – tomatoes is a key example (see previous market update).

- Fertilizer prices driven up as a direct impact.

- Reduction in planting areas is now a key fear.

- Dairy market – cost of drying powder has increased (there is no alternative way)

BRENT CRUDE OIL

Brent crude oil went up 35% over the last 6 months – 102 USD per barrel – 58% YoY. There are several well documented factors for this sudden increase and the impact thereof:

- High demand due to fewer supply options in the market.

- Low inventory, below 5 year average and lowest since 2014.

- Only estimated to recover in last quarter of 2022.

- Pricing are currently moving down, but still higher than previous yearly averages.

- OPEC members will not be able to reach targets.

- Russia/Ukraine Conflict

- We saw an immediate impact in February.

- Daily price movement has driven volatility.

- Sanctions

- Retaliation sanctions.

- US banned all imports of oil.

- UK to phase out all imports by end of 2022.

- EU Russian oil embargo – drop in Russian oil exports now lowest since 2020.

- Reduced reliance on Russian supplies.

- Market uncertainty

- Recession fears

NATURAL GAS

- Peaked at £431.9/100therm

- There’s a reliance of natural gasses in the EU.

- Russia is the top producer so the conflict in Ukraine had an immediate impact

- Prices have continued to rise

- US Natural gas rose from Feb – May 2022 by 81USD/100T (UP 25%)

- This is still much cheaper than Russia

- EIA Gas storage expected to be 9% below average in Q3.

- Sanctions

- US sanctions fully removed Russia

- EU to be fully independent from Russia by 2030

- No EU alternatives to Russian supply

- Russia demanding payment in Roubles

- Russia no longer supplying Poland, Bulgaria, Finland and Dutch/Danish companies as they won’t pay in Roubles

- EU to ration energy in the winter – sourcing alternatives is now a must.

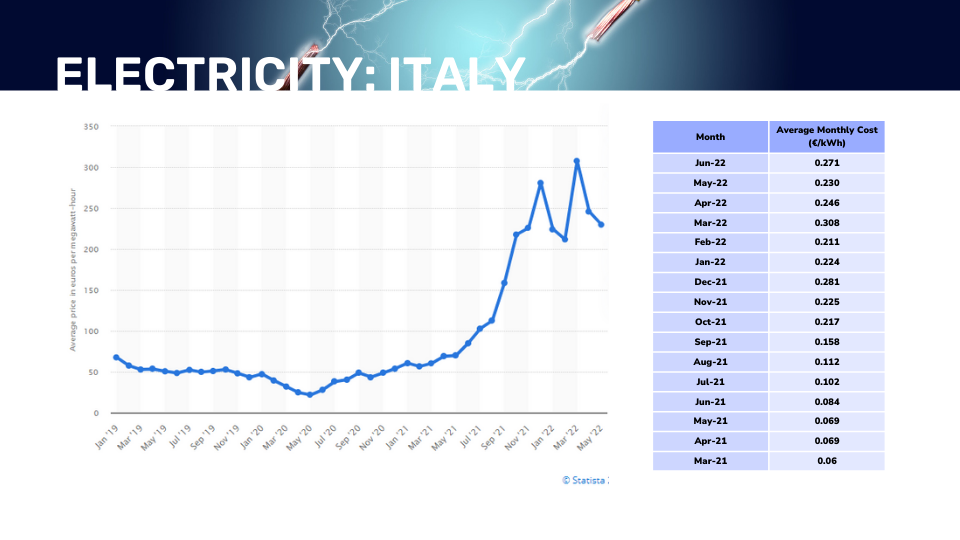

ELECTRCITY

- Prices have risen in line with Gas with consumption expected to return to pre-pandemic levels.

- UK exposed to global surge in electricity pricing, 38% rise in 4 weeks leading up to 13 July 2022 – £101.9/MWH – 278% up YoY (this has an indirect impact).

- Below and to the right Italy’s electricity prices that have a direct impact on production.