OVERVIEW

It is important to recognise that Durum Wheat Semolina attributes a large portion of overall cost in pasta.

However, in today’s climate, energy has become the key driver of increased costs as opposed to the raw material itself. In 2022, the costing of pasta looks entirely different to previous years, and we need to look past the ingredients list to understand the cost.

Aside from Energy, other contributing factors include:

- Transportation cost

- Inflation

- Global demand

- Crop substitution in light of the higher production prices

- Lack of carryover from previous crop

- December 2021 showed stock levels 38% below previous years

For Durum wheat, it makes sense for us to focus on two origins: Italy and Canada.

Canada is the leading producer and exporter of Durum wheat semolina, and Italy are key growers, but also are a very important nation for production and usage of the commodity.

Note, some of the information presented is for wheat, not durum wheat. However, these are correlated.

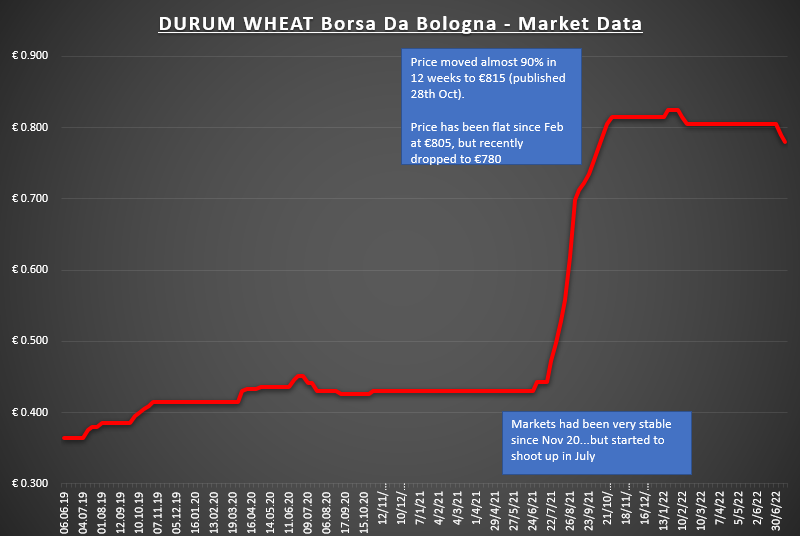

DURUM WHEAT PRICES

The price of Durum wheat semolina rocketed in August/September of 2021. Since then, the commodity has been fluctuating between £450/£500 PER MT.

As the new harvest is underway/reaching its conclusion, the prices are beginning to decline as stocks are replenished. However, the recent heatwaves in Europe will have an impact towards the upside again.

The other important factor to note is that grain is now being exported again from Ukraine, allowing some relief to demand. We’ve also included Russia, just to demonstrate where their pricing sits.

Notes:

- Italy (orange) is EXW pricing; Canada (blue) is FOB.

- If we minus the transport factor from Canada, this would be a lower figure.

- Ukrainian grain is usually destined for animal feed, but the domino effect on supply and demand means that this is a factor in global pricing.

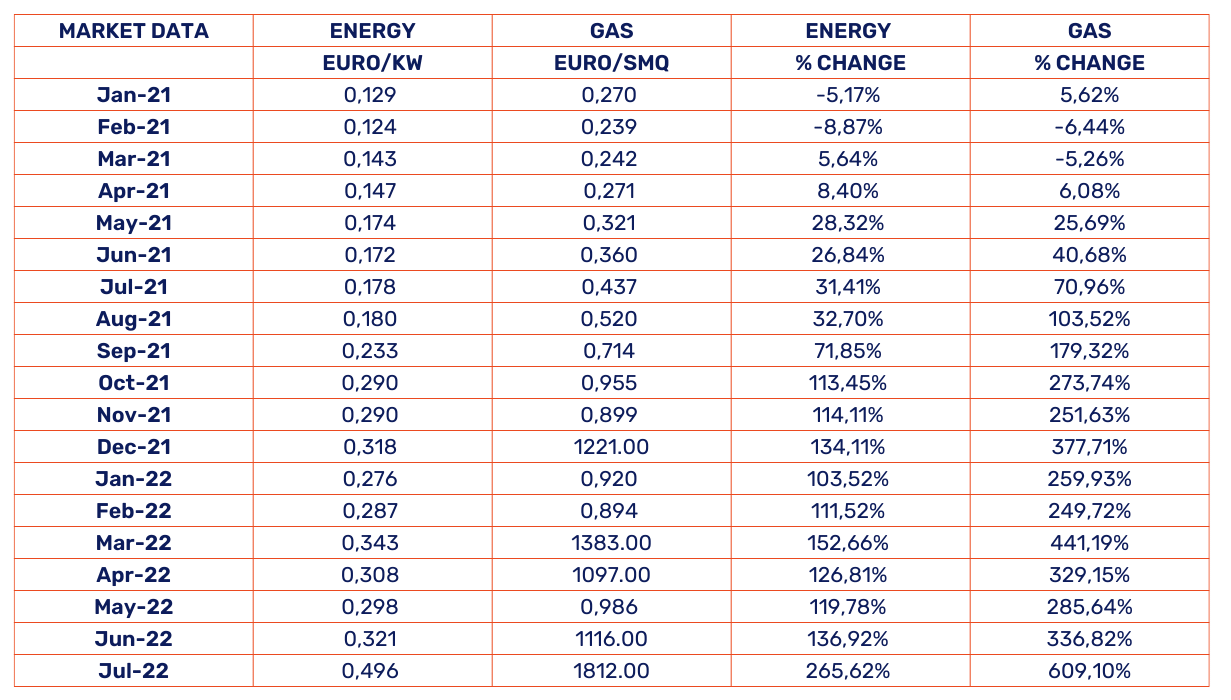

ITALIAN ENERGY AND GAS

Historically energy has made up approximately 4% of the overall cost for pasta production. Due to the recent events in Ukraine and the implications/sanctions connected to Russia, it now represents 17% of the overall cost. This equates to a 304% increase in the energy cost within the cost model.

ITALIAN DURUM WHEAT

- Year on Year pricing is 36.49% higher.

- When considering Italy as a producer/exporter of Durum Wheat Semolina, it is key to take note of the dry, hot weather during the sowing and growing period.

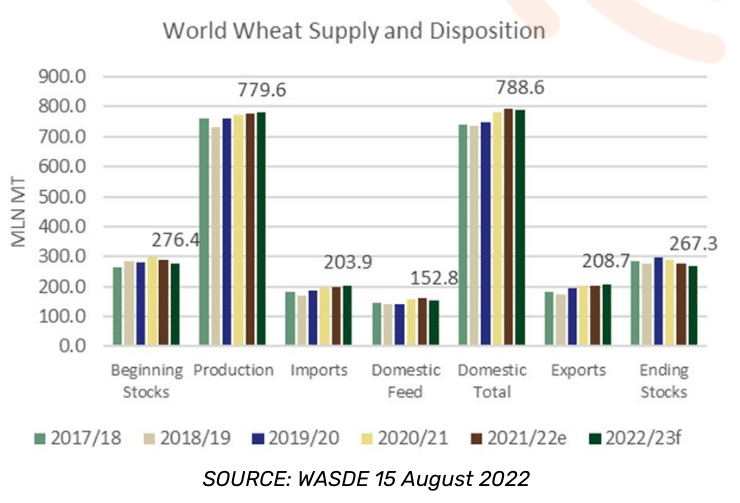

WHEAT OUTLOOK

- The 2022/23 global wheat outlook is for fewer supplies, reduced consumption, higher exports, and increased stocks.

- Supplies are reduced 1.1 million tons to 1,051.7 million as less production is partially offset by larger beginning stocks.

- Production is revised lower for the EU, Ukraine, and Argentina, which is only partially offset by upward revisions for Canada, the United States, and Russia.

- EU production is lowered 2.0 million tons to 134.1 million, as ongoing dry weather lowered yield prospects primarily in Spain, Italy, and Germany.

- Ukraine production is lowered 2.0 million tons to 19.5 million on a reduction in harvested area, as indicated by government statistics.

- Production in Canada is increased 1.0 million tons to 34.0 million on the Statistics Canada Principal Field Crop Areas survey showing higher planted area than intentions.

- Projected 2022/23 global trade is raised 0.9 million tons to 205.5 million as higher exports from Canada and the United States are only partially offset by lower exports from Argentina and the EU.

- World consumption is lowered 1.8 million tons to 784.2 million, primarily on reduced feed and residual use in the EU and Ukraine.

- Projected 2022/23 world ending stocks are raised 0.7 million tons to 267.5 million but remain the lowest since 2016/17.

EU WHEAT OUTLOOK

- Harvest in France has come to an early completion. Hot and dry weather ripened the crop quickly and aided harvest progress. The French Agriculture Ministry says that yields were better than expected, but a smaller seeded area will cause non-durum wheat production to be 4% less than last year at 33.9 million mt.

- The wheat crop in Romania has been harvested. Production there was 15-18% less than last year’s record crop due to higher input costs and drought conditions.

- The USDA decreased EU wheat production by 2.0 million mt to 132.1 million mt. The entirety of the decrease was taken from their trade number which is now at 33.5 million mt – 1.5% higher than last year. This export number is too low. EU exports are currently 30% up on the year and the EU remains the world’s cheapest and most reliable wheat exporter.

- FOB prices in the EU: September 2022 French 11.5 pro wheat closed at $356.2/mt (up $1.10/mt from last week); September 2022 German 12.5 pro wheat closed at $379.20/mt, (up $0.20/mt from last week).

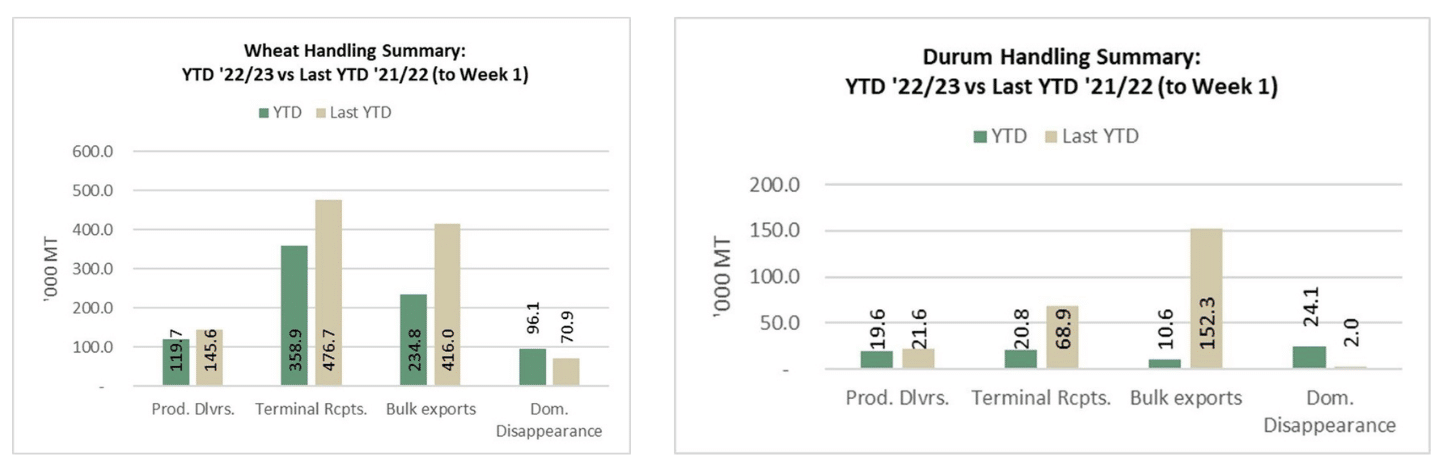

CANADA WHEAT

Crop conditions for Spring 2022 in Alberta have dropped by 3% in the past 2 weeks to 77% (good to excellent quality), meaning less consumable volume is available.

Canada exported 234.8k tonnes of wheat in the first week of shipping season. There are still 1.8m tonnes of old crop supply visible in the supply chain. This will fulfil demand until new crop is available. Large crop in western Canada means that there will be a lot of volume to be transported to manufacturers. This means that there will be pressure on haulage and rail systems to carry grain to its destination. This may inflate operational costs.

Current crop condition is 46% good/excellent, which is down 2% from 2 weeks ago. This is a sign of reduced yield.

Canada exported 10.6k mt of durum in first week of the season. Durum exports are usually low in August/September and pick up in October/November.

SUMMARY

- Fundamentally, pricing is still going up due to heatwaves in Europe and crops being damaged. Pricing is likely to increase unless the current weather pattern changes.

- Corn supplies are also expected to be low this year, so more wheat will be used in animal feed.

- Ukrainian crops have started to be exported. However, wheat export is still very minimal.

- India is looking to scrap the 40% duty on wheat imports as well as limiting the stock holding volume. This will allow India to import higher volumes of wheat and reduce their current pricing.

- USDA figures still suggest that there is 6.5m tonnes being exported from India, and only 300k tonnes being imported.

- Higher import demand will increase pressure on the rest of the world who are importing.

- Traders think that the World Agricultural Supply And Demand Estimates (WASDE) overestimate global wheat supplies by 15m tonnes. This could mean that we see less raw material available than expected.