OVERVIEW

Tomatoes are one of the most important and widely consumed crops worldwide. The World Processing Tomato Council (WPTC) has just released its latest estimates for 2023, suggesting a better season than 2022.

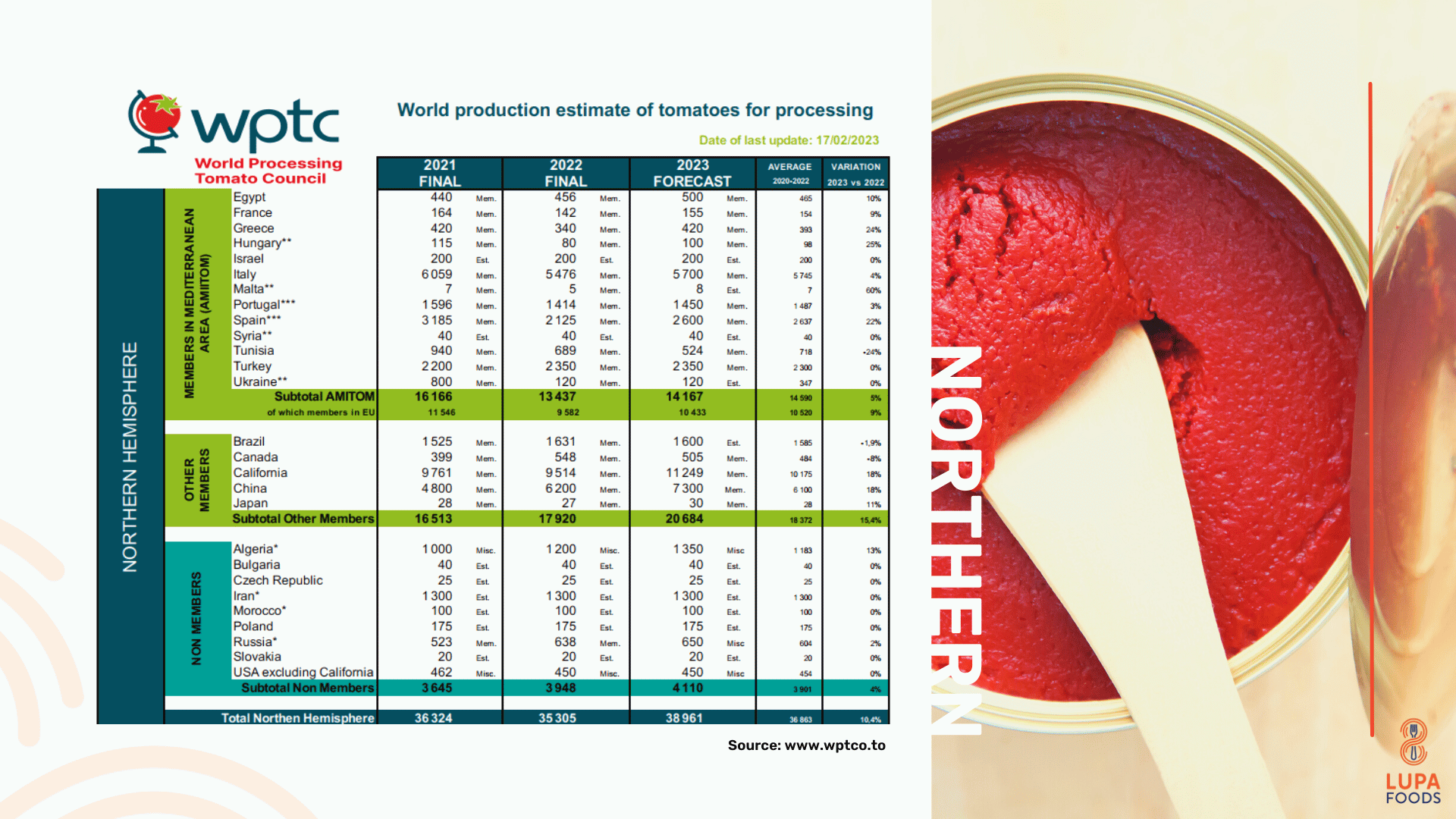

However, it is still too soon to be sure, as the variance between early forecasts and last forecasts (just before harvest) is significant. WPTC estimates that globally, 41.8 million tonnes of tomatoes will be processed in 2023. The reliability of WPTC’s early forecast over the last 10 years has been around +/-6% from actual. According to the report, most countries are maintaining their forecasts from the last report, except for small adjustments for France and Tunisia.

GLOBAL

Global tomato prices have remained in an upward trend in all main producing countries due to rising input costs and energy crises that have affected greenhouse production across the globe. However, in some markets, this trend has slightly eased near the end of the year due to larger availability in the market. While suppliers are forecasting a reasonable season ahead and claim to be coping well with the current season, it is not entirely accurate based on what is expected for next year. The global tomato market is facing several challenges, including rising input costs and energy crises.

NORTHERN HEMISPHERE

Price negotiations are ongoing in most countries. In Spain, prices have slightly decreased over the last months of the year due to a new harvest with large volumes. For the rest of the main markets, tomato prices remained high and are expected to maintain that trend for the first months of 2023.

In Turkey, tomato prices remained high for the second half of 2022 due to flood damage in the Antalya region, but since December 2022, the price has started to decrease. By January 2023, the average price dropped to $1.27/kg, a 7% MoM decrease and a 28% decrease from November 2022.

Prices in Turkey have also been affected by high economic inflation, but the recent decrease in prices is driven by a reported increase in demand from the Middle East and the EU, which has helped to stabilize prices. In China, the current forecast is 7.3 million tonnes.

The forecast for Japan is 30,000 tonnes, but demand is expected to be higher.

Following a challenging season in 2022, there is a greater need to consider integrating supply of goods from other regions. Two regions that are experiencing growth in the current market are Egypt and Turkey.

The benefits of a more stable climate, and a greater period of production can help to improve availability all year round.

SOUTHERN HEMISPHERE

In Argentina, the forecast has been reduced from 665,000 tonnes to 655,000 tonnes due to reduced yields in San Juan following frosts and less uniformity of maturation. The season is progressing well with dry weather and good temperatures, and 35-40% of the surface has already been harvested.

In Australia, floods during planting and high winds and low temperatures later in the season have led to reduced yields, and the harvest started in February instead of the end of January, with a forecast now reduced to 139,000 tonnes.

In Chile, there is no change to the forecast of 1.15 million tonnes, and the harvest is progressing well. In Peru, the harvest is good and will finish by March, with an expected total of 150,000 tonnes.